Andhra Bank : Online Registration of Mobile Number For Mobile Banking Services

Organisation : Andhra Bank(andhrabank.in)

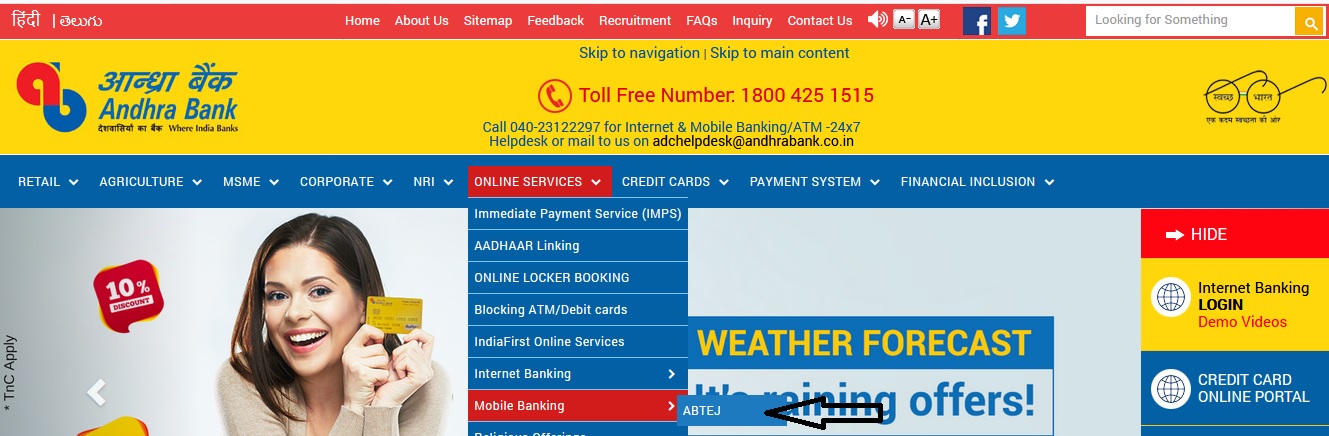

Facility : Registration of Mobile Number for Mobile Banking Services Online

Location : Hyderabad

Website : https://www.andhrabank.in/english/home.aspx

| Want to comment on this post? Go to bottom of this page. |

|---|

Related :

Interbank Mobile Payment Service :

www.indianjobtalks.in/4147.htmlGet Account Balance by SMS :

www.indianjobtalks.in/14250.html

Basic requirements for availing AB-Mobile Banking Services are :

** Customer should have an Andhra Bank ATM/Debit Card.

** Customer should have registered his / her Mobile Number for SMS alerts.

** Customers having any basic Mobile handset can avail of the various facilities including intra/interbank fund transfer thru SMS Mode subject to a maximum of Rs.5000.00 per day.

** Customers having Mobile handset with JAVA and GPRS (General Packet Radio Service – enabled by the Service Provider) can download the Mobile Banking Application on their mobile and avail of the various facilities including intra/interbank fund transfer subject to a maximum of Rs.50,000.00 per day.

** Customers whose hand sets are not Java / GPRS enabled, can also avail of Mobile Banking thru SMS or USSD (Unstructured Supplementary Service Data).(Presently this facility available for BSNL/MTNL user only)

Facilities/Options

** Balance Enquiry

** Mini Statement

Immediate Payment Service (IMPS) :

** To Mobile Number (Using MMID & Mobile No)(P2P)

** To Account Number (Using IFSC Code & Account No)(P2A)

** Funds Transfer (Rs.50,000/- per day is allowed through Mobile Banking)

(a) Within Bank :

** Mobile to Mobile (Beneficiary should be our Mobile Banking Customer)

** Mobile to Account (Any account of Andhra Bank)

My Services :

** Mobile Recharge

** Temple Donations

Other Services :

** Cheque Status

** Stop Cheque

My Setup :(Application options can be configured as per customer requirement)

** mPIN Change

** Inbox

** About AB-mPAY

For Funds transfer, Customer has to register the Beneficiary details as a one-time registration. After registering the beneficiary, funds can be transferred by selecting the beneficiary. For every fund transfer transaction, system will generate a message and send to the Customer’s mobile. Customer can also use Quick IMPS/Payment for funds transfer.

mPAY Application

Invoke the “mPAY” application available in Applications/Games folder. Enter the application PIN to get the menu which will have the following options.

1) Balance Enquiry :

Customers can view the balance in the account which has been registered for mPAY.

2) Mini Statement :

Last 9 transactions (both credit and debit legs) in the registered account can be viewed using this option.

3) Funds Transfer :

(A) Within our Bank :

Mobile to Mobile :

For using Mobile to Mobile fund transfer facility, beneficiary should also be a registered mPAY customer and needs to give the mobile number of the beneficiary at the time of registration.

Mobile to Account :

Customers can transfer funds to any of the Andhra Bank accounts. In this case, beneficiary need not be a mobile banking customer

B) Other Bank :

Bank has provided IMPS services to our customers through NPCI for remitting funds to and receives funds from other bank account holders. Interbank Mobile Payment Service (IMPS) is an instant real time interbank electronic fund transfer service through mobile phones.

It facilitates customers to use mobile phone as a channel for remitting funds to accounts in other banks. The pre-requisites for fund transfer through IMPS is both the remitter and beneficiary needs to register their mobile phones with their bank account and get the MMID upon registration.

MMID (Mobile Money Identifier) is a seven digit code issued by the participating banks to their customers for availing IMPS services.

MMID Generation

The MMID can be generated in two ways:

For using Mobile to Mobile fund transfer facility, beneficiary should also be a registered mPAY customer and needs to give the mobile number of the beneficiary at the time of registration.

Using mPAY Application :

Mobile banking customers of the bank can generate the MMID using the mPAY application available in their handset through the option FUND Transfer à Other Banks à IMPS à Generate MMID

Using SMS Tags :

For availing IMPS facility in case of non-mobile banking customers, their mobile number should be registered with the bank for SMS alerts. For getting the MMID, the customer needs to send SMS as <MMID> to 9223173924. This is required for receiving funds from other bank customers.

Fund transfer through IMPS

Using mPAY Application :

Funds can be remitted to other bank accounts using the option Fund Transfer à Other Banks à IMPS à Quick IMPS. Customers can use this facility for one time remittance of funds. Customers have to enter the beneficiary mobile number, MMID and Amount for transfer of funds.

Customers can also register beneficiary details for repetitive payments by giving beneficiary Mobile number, MMID and Nick Name using the option Fund Transfer à Other Banks à IMPS à Register IMPS.

Payment :

Customer has to select the beneficiary (to whom funds to be transferred) from the list which will appear in the screen.

Beneficiary De-Registration :

Customers can de-register the already added beneficiary using this option.

Using SMS Tags :

This facility can be used by the customer who has registered for Mobile Banking and not installed the application in handset The syntax for remitting funds using SMS tags is :

IMPS<Space><Beneficiary Mobile Number><Space><Beneficiary MMID><Space><Amount><Space><MPIN>

Where <Space> stands for one blank space.

IMPS Fund Transfer Limit :

There is a daily cap of Rs. 50,000/- for customers who is remitting funds using the mPAY application and Rs. 5000/- for other customers who is availing the facility through SMS Tags. The charges for SMS and GPRS are as per the tariff provided by each service provider.

4) My Services :

Mobile RechargeCustomers can do mobile recharge for any prepaid/postpaid mobile number for the amounts between Rs. 10/- and Rs. 1,000/-

Movie Ticketing : Customer can book movie tickets using this option.

Temple Donation : At present customers can donate funds to Tirumala Tirupathi Devasthanam (TTD) and Shridi SaiBaba Samsthan

Other Services :

Stop Cheque :

Enter mPin and cheque number. Get successful message if cheque is not already paid.

Cheque Status :

Enter mPin and cheque number. Get the successful message on status of the cheque.

5) My Setup :

Enable or Disable Transactions : Enable or disable the transactions in your application.

mPAY service Number : Two Service Numbers are provided. Please do not change it.

Save Inbox in Memory : Select YES in order to save the message received in the inbox.

Communication Mode : Can be set as either GPRS or SMS according to customer requirement.

Re-Activate Application : Customers can re-activate the disabled application using this option.

Configure E-Mail Id : This used to capture the email id of the customer. This will be useful at the time of Movie Ticketing.

Change mPIN : If customer wants to change the mPin, select this option. Then enter the old mPin, new mPin, then re-enter the new mPin, Click ‘Yes’ for “Allow application ABmobile to send text message?”.

Inbox : Inbox includes last five responses received.

Contact us :

Andhra Bank

5-9-11, Dr Pattabhi Bhavan,

Secretariat Road, Saifabad

Hyderabad 500 004. A.P.

Please guide me to update my mobile number in my bank account.

I have an account in Andhra Bank. When I am trying to add my bank account in Paytm, Phone Pe, Google Tez, it shows can’t find any account with this mobile number but I am getting OTP when I use ATM card. Please tell me

I want to change my registered mobile Number.

How can I stop advertisements in my mobile alert banking account? Because I’m in Do not disturb service. But I’m receiving more SMS every hours.

I want to change my registered mobile number. How can I do that?

Kindly contact the helpdesk of Andhra Bank

Toll Free Number:1800 425 1515

You check in online or go to bank.

How can I change my new mobile number?

How can we change our account mobile number from old number to new mobile number online?

How can we change our registered mobile number from old number to new mobile number online?

How can we change our account mobile number from old number to new mobile number online?

How can we change our account mobile number form old number to new mobile number online?

How can we change our account mobile number form old number to new mobile number online?

How can we change our account mobile number form old number to new mobile number online?

Godugumupalli (vi)Gudynampalli (pot) Penumur (md)

Chittoor (dt) Kothapalli bach

Customer has to visit any andhra bank atm and register for mobile banking services

I want to change my mobile number. Can you tell me how can I do that?

YOU VISIT YOUR BRANCH AND APPLY FOR REGISTRATION OF NEW MOBILE NO.

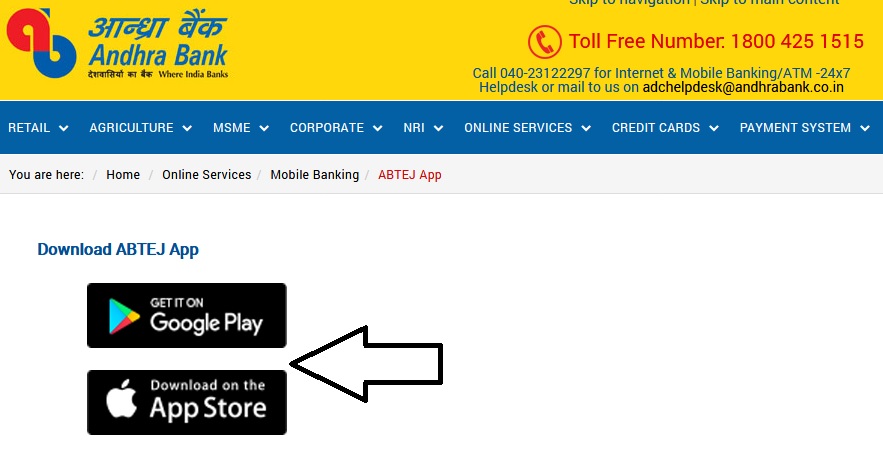

Can you tell me how to download Andhra bank application in mobile?

Change my mobile number

How shall I update my contact number through the atm for receiving alerts or to get recovered password in the phone?

The customer is responsible for intimating to Andhra Bank any change in his Mobile Phone Number.

The customer acknowledges that to receive alerts, his mobile phone number must be active and accessible. The customer acknowledges that if the customer’s mobile phone number remains inaccessible for a continuous period (such period dependent upon service providers) from the time an Alert message is sent by Andhra Bank, that particular message may not be received by the customer.

Triggers will be processed by Andhra Bank after receipt and Andhra Bank shall have the discretion to determine the time taken to process such request.

How to know my sb a/c balance by calling from my mobile phone?

Mobile banking registration

I want to get sms alert

What I want to do and where I should submit my mobile no?

Customer should have registered his / her Mobile Number for SMS alerts.

Customer has to visit any Andhra Bank ATM and register for Mobile Banking Services.

I want debit card

APPLY FOR DEBIT CARD, BANK ISSUE DEBIT CARD IMMEDIATELY.

I want debit card

Please note that this facility is for registration of Mobile Number for Mobile Banking Services Online.

Please Register my mobile number for sms alerts.

Customer has to visit any Andhra Bank ATM and register for Mobile Banking Services

I want mobile banking.